Score small household money and you may first recognition within 60 minutes, whenever you pass our credit checks and your software program is inline to your responsible financing password of brand new Zealand. Spread repayments across a number of years, with reasonable and down loans prices, and enjoy the freedoms of getting a property on the move.

Workout The Lightweight Household Payments.

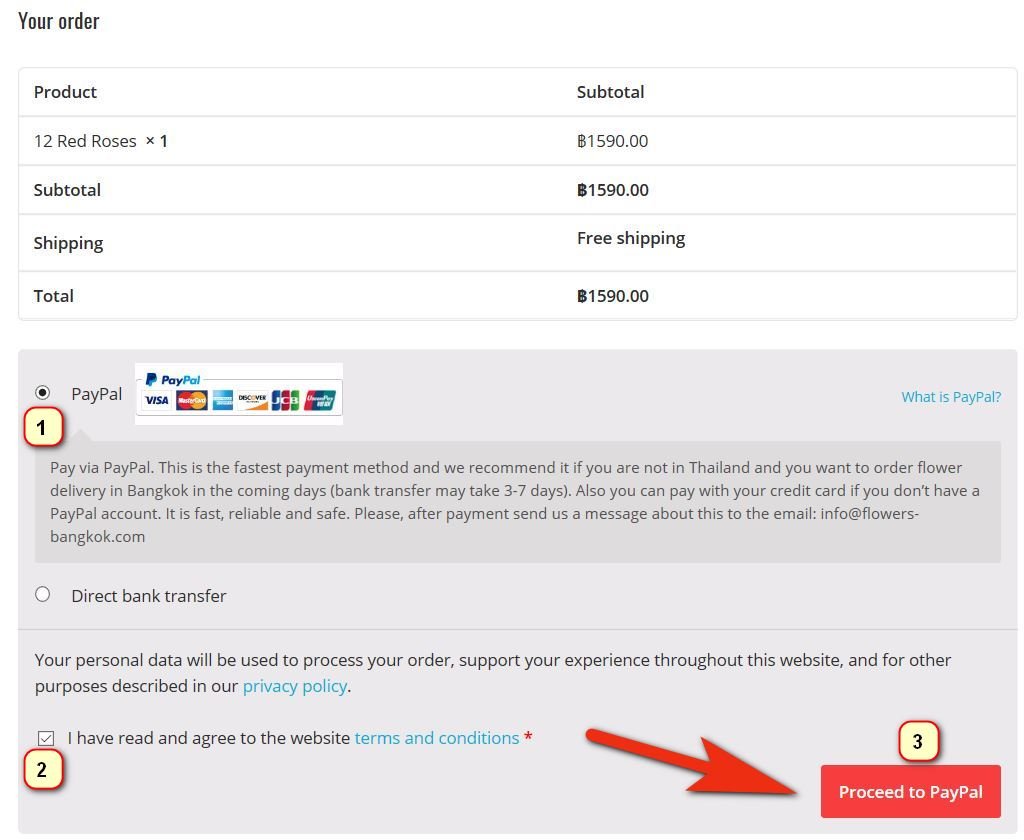

Choose your own repayment numbers, therefore the size and/or label into the car loans calculator less than. It is easy. Shortly after you’re happy, simply, smack the implement today option, therefore we get the program started. This can grab everything six-8 times to accomplish.

$ 29 per week

All of our restrict mortgage label are 3 years so that your costs for the an effective $6650 mortgage should be $70 (or even more) per week

- Your computer data is safe

Tiny Household Fund Will set you back

If you’re investment a little household, then yes, discover going to be a destination cost. Essentially, it’s possible to rent your typical household out if you find yourself taking a trip the gorgeous Aotearoa, to pay to own stamina and you can travel will cost you. Otherwise, this may be could well be an inspired suggestion to think about functioning from another location which have a laptop, which means you need an https://paydayloancolorado.net/victor/ effective Wi-Fi union otherwise Elon Musk’s the new satellite.

You could potentially plan all improvements, variations, and you may jewellery into the solitary fund plan. You will then need to comparison shop on low rates of interest out of all the finance companies within the Brand new Zealand, plus the ideal standards, and you may hopefully you will be straight back at Crester, provided you as your most useful lightweight financial alternative.

All of our calculator visits all in all, $100,000 NZD, in case you’re quite more than one to endurance, it’s no crisis, and when you can afford they and you’ve got the right matter out-of safeguards towards loan. Contemplate, it is far from only the mortgage on the small domestic needed, it’s the jewellery, the Wi-Fi effectiveness while the over put-up which you are able to need certainly to finance. Constantly add in a contingency basis out-of 10% when selecting, thus you may be open to invisible costs.

To find the fresh & promoting a moment-give smaller household.

The great thing about financial support a different sort of tiny home is you to they don’t have a top decline rate, such as an iphone 3gs otherwise a car you are going to. These include much more exactly like an effective caravan or trailer, along with days of inflation, discover they have been holding their philosophy well. The great thing doing before you make a purchase will be to search simply how much your own small household will be well worth into the 4 years’ time. Whenever you can sell it having lots of new unique worth in the cuatro years’ time, then it’s any worthwhile and you will upgrading, and that means you will have a new tiny house would be with the the new cards, and in case you can afford it.

Helpful tips

Do i need to sell my personal lightweight household through to the finance agreement was finished? When you need to offer their tiny domestic ahead of the fund arrangement completing, upcoming we can arrive at a binding agreement, however you need certainly to call us first. The tiny Residence is beneath the fund companies’ possession, because it’s made use of since the defense so you can counterbalance the mortgage. It should be marketed at ount should be compensated instantaneously upon product sales.

What happens if i rating a year down the song and can’t afford the brand new payments. Existence changes possibly, however, be confident, we’re in charge loan providers, and only lend to those who will pay the funds these are typically making an application for. In the event you get into a gluey disease, there are numerous alternatives, so it is better to contact us, but you to definitely chance is the fact we are able to evaluate refinancing, which lowers your instalments more a lengthier term.

Must i pay my little financial away from less? Yes, we remind one pay as soon as possible to reduce your current price of desire. When you have most funds, it is definitely a pretty wise solution as directing them to the loan.

Interest rates towards the small household funding Rates may differ, but constantly we offer money of % to % that have a phrase over a period of up to forty-eight weeks. Getting big commands, the eye pricing are on lower end of one’s measure. Tiny belongings are usually believed higher requests.

If i keeps financing pre-approved, the length of time carry out I want to buy? Just after approved, you will have 3 months and work out a buy, otherwise, our company is legally obliged on how to complete new paperwork since the evidence of the income, plus borrowing checks, etcetera.

How much deposit am i going to you prefer? When getting into any funds contract to own a tiny, Crester Credit searches for a deposit anywhere between 10-20%, along with getting cover.

Ought i remain my personal insurance advanced? Sure, as part of the funds contract, you really need to continue insurance policies cutting edge. It is vital otherwise you’ll be during the violation of your own agreement.

Do I need even more cover to possess little a home loan? Yes, i ask for in initial deposit, also defense, where you’ll be able to.

Implement Today & You will end up Passed by

Our online form requires only half a dozen-eight times accomplish. Start by completing which inside the, whenever you want to talk to a financing officials, excite put in writing it about application.