What is property Structure Mortgage

Mortgage brokers is long-identity secured loans for purchasing a property, area, otherwise belongings, and/otherwise building property with the a parcel of land. You can use the cash regarding any financial since an effective design loan.

Since family framework finance try secured finance, you can aquire them quickly even after all the way down credit ratings. Why don’t we check particular biggest banks’ framework mortgage desire cost.

Big Banks’ Build Mortgage Interest levels

The borrowed funds amount and interest levels can differ with respect to the conditions of the borrower. You can become familiar with design mortgage rates of interest of individuals banking institutions.

On pursuing the dining table, interest levels and you will processing costs of a few significant banking institutions was stated. Please be aware why these rates are at the mercy of transform during the bank’s discernment. The newest rates listed below is common as of 2023.

Home Framework Financing Qualification and you can Files

The home structure mortgage eligibility conditions you’ll are different some based on the loan provider. Overall, you ought to meet with the following the standards is qualified to receive an excellent house structure financing –

- Years should be between 21 and you may 65

- You truly need to have a steady revenue stream

- You must have a significant credit history

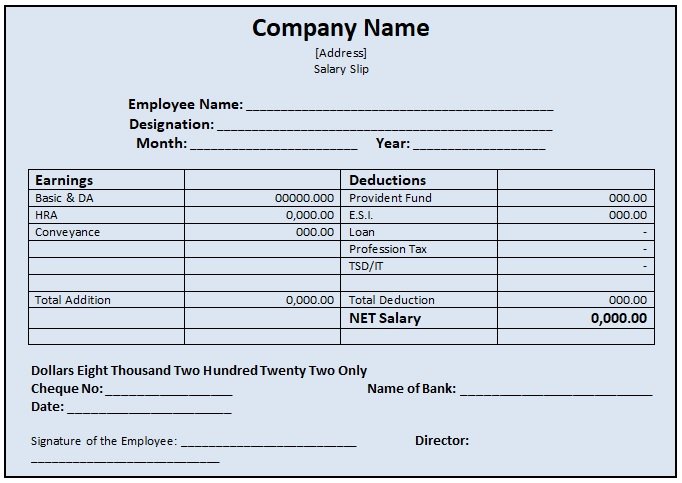

Getting your records under control really helps the process of an excellent financing convenient. It is reveal variety of records you’ll need for a home structure financing. Part of the data files called for are listed below –

- Duly occupied and you can closed application for the loan form

- Identity evidence

- House evidence

- Passport size pictures

- Earnings papers/declaration

- Files concerning real estate otherwise assets

Personal loans away from moneyview while the a property Mortgage

Either bringing a home loan of a bank might twist a great condition. In these instances, you Georgia quick cash locations could choose for quick unsecured loans away from moneyview to fund your residence design. There are numerous advantages of getting a consumer loan out of moneyview –

Achievement

If you’re looking for a loan to construct your home, a property design financing is the best choice for you. Money from property design loan can be used to pick a plot as well as remodel a current domestic.

The federal government from Asia has some strategies to possess giving subsidized house funds, and you can house build funds likewise have tax positives. Household design financing is secured finance and also have long tenures, causing them to good for huge spending on possessions.

So you can get straight down interest rates, you should check with various finance companies ahead of zeroing in the using one lender. Figuring your own EMI in advance can also help you plan your finances in the progress, thus making it easier in order to sail by this large financing.

Domestic Design Finance – Related Faqs

After you’ve decided that you should need a house structure financing, you ought to check out individuals finance companies to check their small print. SBI, Main Financial out-of Asia, HDFC Bank, an such like. are typical a beneficial options for you, however, and therefore lender is perfect for your depends on your unique situation.

You simply cannot score 100% of the property rate since the a home loan about financial, very banking institutions will money merely 80% of the house rate. Planning having a larger down-payment in advance is additionally a good way to minimize the duty out-of a huge mortgage.

Sure, you should buy income tax pros towards attract component of family construction money below Part 24. For personal property, you could claim up to Rs.2 Lakh for individuals who complete the build inside 5 years out of the fresh new sanction of mortgage.

Yes, funds from a mortgage are often used to purchase a good patch also to construct a house inside.

Home loans is collateral-100 % free and you can include enough advantages instance a lot of time tenures, affordable interest rates, income tax advantages, etc.