Throughout what you owe layer acting, you have got after that prominent and you may attention repayments you need so you’re able to deploy instantaneously.

The fresh new FHLBNY’s Callable Improve gives players the choice to help you extinguish the fresh credit without prepayment fee, in whole or perhaps in part, once a pre-determined lockout several months. Members can either pick a-one-big date substitute for extinguish (European) or can purchase a substitute for prepay on an effective every quarter base (Bermudan) following the lockout months. Discover a small advanced on this improve depending on the label additionally the length of brand new lockout; but not, the flexibility so it funding affords you will definitely prove to be most valuable. So just why make use of the Callable Get better?

Short-identity FHLBNY enhances can potentially enable you to guide bonds otherwise money assets now within the anticipation of the future cash circulates, and you http://paydayloanalabama.com/cleveland/ will instantly start realizing online focus money

1. Would be to cost continue to be static, decline, otherwise change somewhat, you can extinguish pursuing the lockout several months and you can rebook an advance during the a reduced rate that have a similar remaining average-life, that may greatly reduce the typical price of the strategy.

dos. In case the put legs otherwise investment combine transform the place you no lengthened require a lot of time-identity financial support, you can also simply extinguish free. For individuals who require identity money to take the institution in the alignment along with your ALM endurance levels, it’s also possible to book a term Callable Progress on goal of restructuring your debts layer and you can extinguishing pursuing the lockout.

step three. If prepayment speed for the mortgage loans is actually reduced than envisioned, you’ll be able to partially extinguish a beneficial Callable Improve and maintain the specific quantity of name resource you need.

Professionals used the quick-term get better options to prefund activity of brand new twigs. According to budgeted coming inflows away from deposits, professionals can optimize profits instantaneously within the new branch by using FHLBNY liquidity to begin with expanding the advantage ft. When put get together perform beginning to obtain traction, players can just only pay off its small-identity borrowings.

Using Improves to help you Up-date Home loan Financing Delivery Assistance

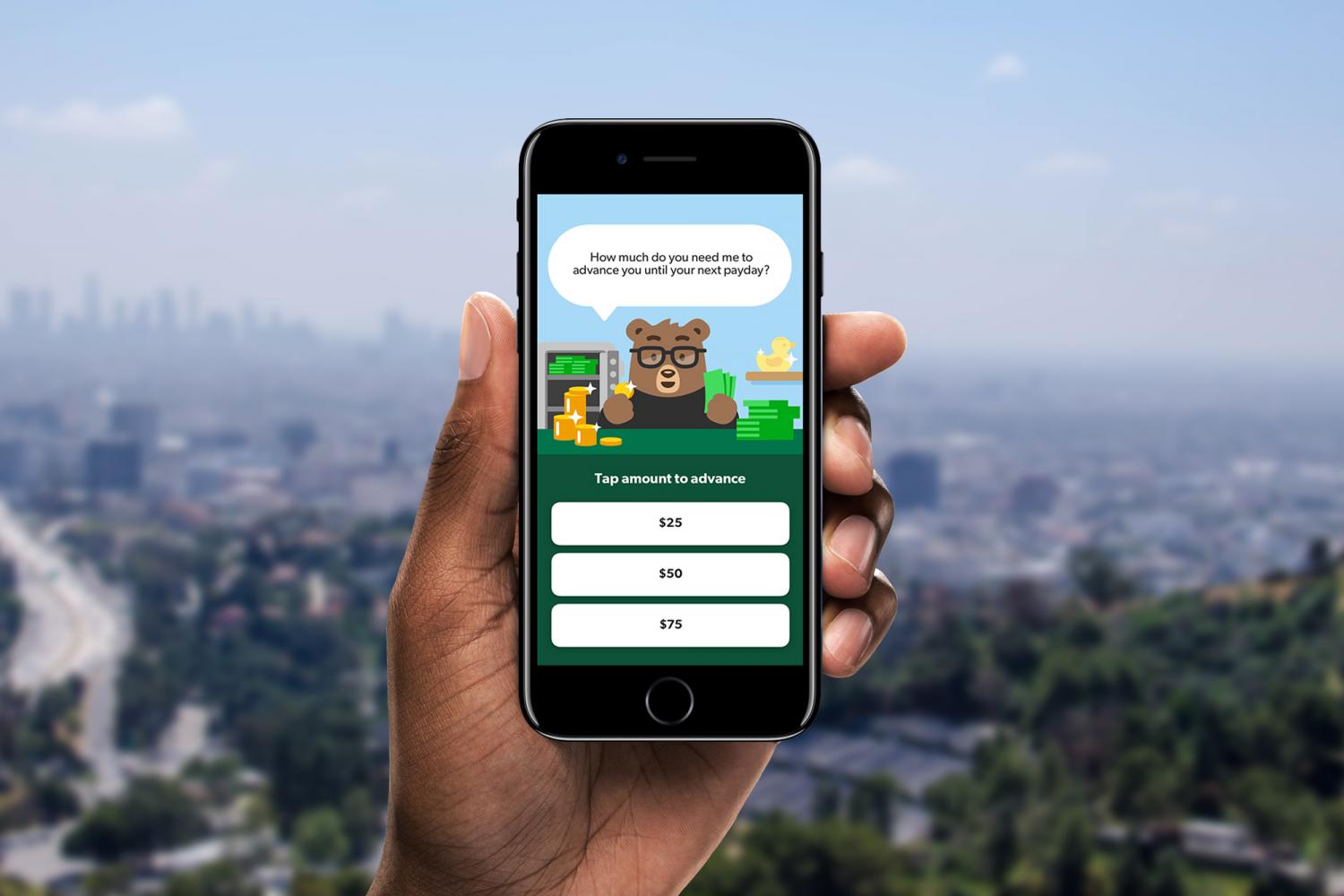

You will find an extensive diversity off lenders within cooperative you to definitely promote rewarding customized solution, which gives them an aggressive virtue whenever writing about new unique products of its customers. However, there’s been an unquestionable transformation taking place about financial financing landscaping due the fresh quick advancement regarding monetary technical systems along side early in the day years. Frictionless lending is the name which had been created into the tech that allows people to track down mortgages and other financing through their wise phones therefore the Websites, which will be quick as the norm. It technical advancement goes without saying of the trend inside the domestic financial underwriting, as there could have been explosive increases amongst nonbank financial originations more than the last few years. Into the Financial Money Courses, Inc. reported that during the 2008 nonbank home loan originations accounted for twenty seven% of the many home loan originations, as well as in nearly seven age climbed in order to everything 48% by Q1 2016. It’s estimated that nonbank originations has recently surpassed regarding banking companies and you will accounted for over 50 % of all of the mortgage originations inside the the latest You.S. at the time of Q3 2016.

Due to the fact people in the new millennial age group, the largest cohort of your inhabitants from the You.S. (estimated becoming over 90 mil) come to life members throughout the market and housing market, the availability of reliable mobile delivery expertise might be a lot more crucial. In a nutshell, the look at would be the fact technical invention can not be forgotten – it should be welcomed. Enough time has become having professionals to look at improving the tech-centered networks to help you compete and you may associated inside home loan underwriting and also in almost every other financing sectors.