Due to the fact indicated significantly more than, of several lenders you should never also techniques a mortgage rather than an income tax return. Whenever you are in this situation, you ought to get most recent on the productivity.

People merely get home financing, rating accredited, and choose aside their dream domestic. For most people, although not, the process is not as simple. You might have to spend time preparing your money before you happen to be ready to apply. Don’t worry – you’re not by yourself, and you can score advice about this course of action.

You’ll find realtors who work having members with less than perfect credit. Such agents offer their customers advice for how-to arranged its finances so that they can obtain a mortgage payday loans Tariffville. Most of the time, yet not, they work at individual debts such as credit cards. To obtain assistance with unfiled tax returns, you should consult an income tax elite group.

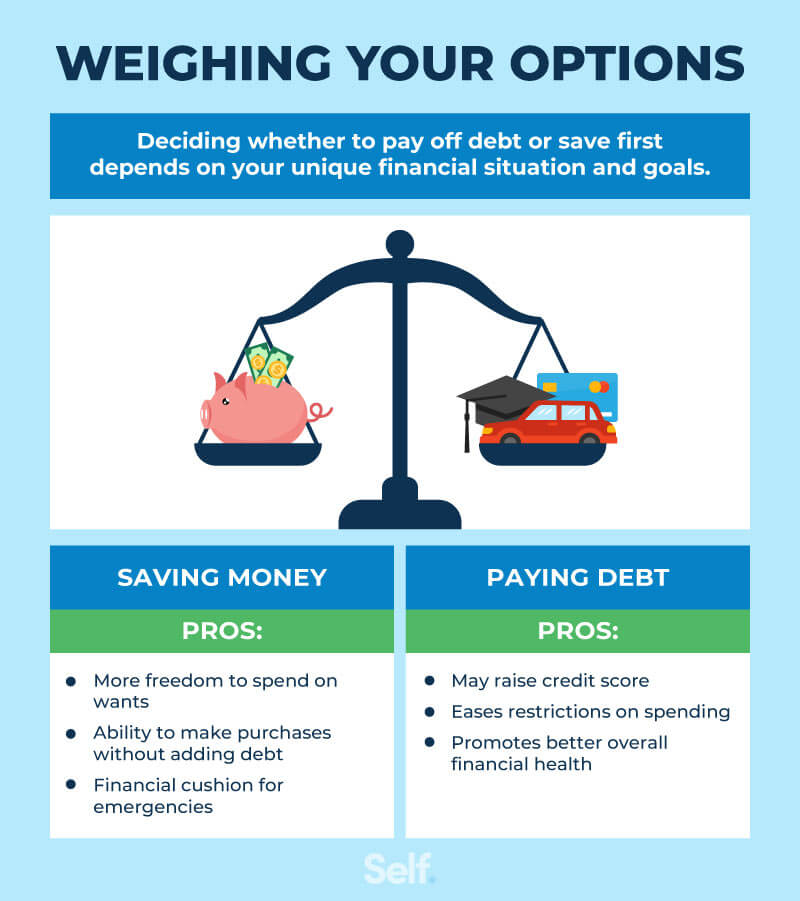

Filing past-due tax statements or repaying obligations takes some time, but these measures tend to put you during the a stronger financial position. As you prepare to put on, it will be easier so you’re able to be eligible for a reduced-down-payment mortgage which have a lesser rate of interest than it might getting if not.

Delivering a mortgage For those who have a taxation Lien

In many cases, if not document the efficiency, the newest Internal revenue service often file money in your stead (SFR), and you can are obligated to pay the fresh new reviewed count. Following, brand new Irs is also place a tax lien at your residence to own the delinquent taxes. Capable including put a taxation lien at your residence in the event that you’ve registered their taxation statements however, have not paid the fresh new goverment tax bill.

A taxation lien is the IRS’s judge claim to your residence, also it can build acquiring home financing challenging. It is possible to contact an income tax lawyer to get the lien removed or perhaps to build a payment bundle towards Internal revenue service.

Often, the brand new tax liens remain in set when you are and then make payments, as well as in this situation, you might have to get good subordination contract on the Irs. Which claims your Internal revenue service try second to your lien place by the mortgage lender in your home. Should your bank should foreclose, this means that it get money very first together with Internal revenue service becomes paid off second.

Obtaining a mortgage After you Are obligated to pay Taxation

If you’re and work out payments on the tax bill, make an effort to inform you the borrowed funds financial their payment contract. Really lenders need to select a stronger history of repayments – whenever you are simply into the times one or two, you may need to wait a bit before you can be considered on financial.

Generally, you would not be able to get a mortgage for folks who enjoys delinquent taxes. Once more, lenders want to be positive that you could potentially pay the borrowed funds. He’s reluctant to focus on people that let you know signs and symptoms of not conference the financial obligations.

Rating Advice about Unfiled Output and you may Income tax Expenses

Within W Taxation Group, we concentrate on providing individuals with unfiled tax returns and you may later fees owed. We are able to assist you with your delinquent taxation statements and you can straight back fees being get a home loan.

Don’t let are at the rear of in your tax returns otherwise taxation apply to your perfect from homeownership. Why don’t we help you look after the Internal revenue service and condition income tax points so you can progress and buy property. To learn more, contact us now.

Loan providers use your tax returns to verify your income. Nonetheless they look at the W2s or other money statements. Devoid of verifiable tax returns try a red flag you may not be in control adequate to pay their mortgage.