To buy a primary house is a key milestone in life although medical, dental and veterinarian professionals will enjoy benefits when it comes to protecting a mortgage, you’ll find issues to understand.

Very first home is a whole lot more than simply a threshold more their direct. The house is also a valuable asset, one which would be to take pleasure in inside the really worth over time.

Actually, of many medical professionals love to keep the basic family and rehearse it as an investment property if they are ready to change on the second home. For this reason they both is useful possess an investor psychology although you is to invest in a property to live in.

payday loan? not, well before you start probably discover home’ monitors, it is really worth delivering about three very early learning to make your house to buy excursion because seamless you could.

step one. Encircle yourself having benefits

To acquire a first family can be cover a high discovering curve and you desire to be sure you earn they proper.

Get together several pros just streamlines this new to purchase process, in addition, it offers the main benefit of top-notch solutions to cease pricey problems.

Your people out-of benefits is to preferably include a large financial company you to specialises in your industry eg Avant Loans. It is because an expert fund merchant will have comprehensive training out-of ds, career vacations and you may borrowing from the bank pages, which is essential with regards to protecting a great mortgage.

A reliable solicitor or conveyancer must means part of your own class such Avant Laws. The part will be to comment a good property’s product sales package, and you can pick people clauses that’ll work against your, together with making sure a hassle-free transfer of the house into your name.

To have doctors, dentists and you will vets who will be go out-bad or to purchase for the an unfamiliar urban area, an expert client’s broker can be a very important introduction for the cluster.

Because the a primary family buyer you happen to be eligible to an excellent monetary helping hands as a result of various effort. It’s well worth understanding what’s up getting holds.

Such as for instance, The initial Resident Grant, varies across Australian claims and territories, and can feel really worth anywhere between $ten,000 and up so you’re able to $15,000 step 1 .

Other available choices through the Very first Family Be sure dos that enables very first home buyers to access the market industry with as low as 5% deposit. However, medical professionals, dentists and you will vets discover preferential cures out-of loan providers as they are provided low deposit mortgage selection too.

Conditions and you may eligibility standards usually connect with such techniques. Your own Avant Finance financing expert normally explain people efforts you’ll be able to qualify for.

step three. Get money from inside the great figure

After you make an application for a home loan, lenders will want to discover a robust track record of protecting, even though some banking institutions may also envision normal book repayments as offers history’.

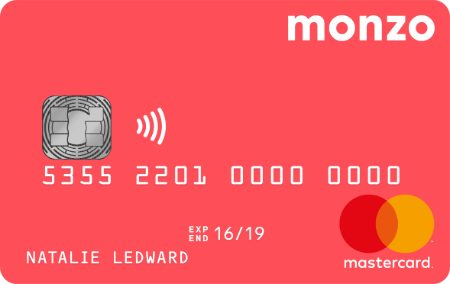

What is actually reduced noticeable is the fact a bank will appear within total borrowing limit on your mastercard instead of the outstanding harmony. This as the case, it can be sensible calling your own card issuer so you can demand a beneficial reduction in your own credit limit before applying for a loan.

While these kinds of issues are common to all the first house consumers, scientific, dental and you will veterinarian positives normally face a lot more considerations.

In particular, it’s quite common for medical professionals to carry an enormous HECS obligations. Dily to spend down as much of its HECS harmony since the you can just before making an application for a loan.

Yet not, this might really works up against you. The total amount due inside the HECS often is out of reduced desire in order to a lender compared to fact you’ve got a good HECS obligations.