Va finance are specially built to promote effective-obligations army, pros and you can eligible spouses assistance inside the to buy otherwise refinancing a property. These are typically backed by the brand new U.S. Agency away from Veterans Activities and provide individuals advantages, however you need meet specific services requirements and supply an excellent Certificate off Eligibility in the Va.

There are many advantages to Va money, such as a beneficial $0 deposit and you will competitive interest levels to possess eligible experts and you can army teams. When you find yourself conventional money be accessible, you normally have to spend currency down and satisfy significantly more stringent conditions.

Financing qualifications standards

Being qualified to own good Virtual assistant financing is principally associated with their military service checklist and you may standing. Active-duty service members, honorably released experts, Federal Shield and you can Set aside professionals which satisfy services criteria and you can particular thriving partners are usually qualified.

You will also you want a certificate out of Eligibility on the Virtual assistant given that evidence of your solution. Virtual assistant money are far more flexible than just old-fashioned financing away from credit conditions, however, loan providers can always consider your credit score and you may income to determine whether you can afford the mortgage you are making an application for.

Your house you buy that have good Virtual assistant mortgage needs to meet the VA’s conditions to possess security and habitability, plus it have to be your primary residence.

Antique loan requirements differ however they are generally more strict than just government-backed loans. You will constantly you prefer a credit score of at least 700 for the greatest interest rates. The newest stronger your credit report, the more likely you are to meet the requirements – expect you’ll give records that demonstrate proof income, lender comments plus to show economic balances.

You will also need certainly to meet assets requirements to have old-fashioned finance and pay money for an appraisal to choose the property’s standing and cost.

Loan closing costs and you may charge

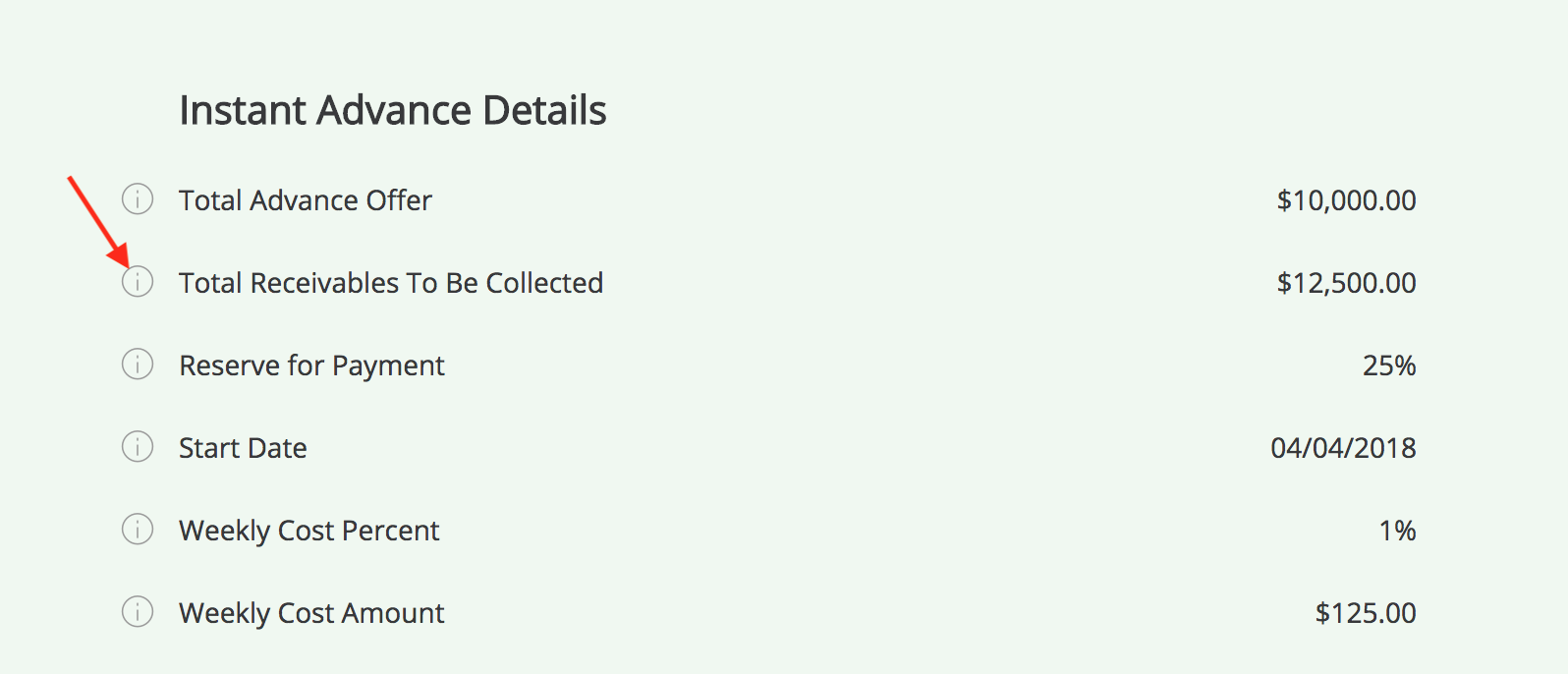

Virtual assistant financing need a financing fee most of the time, a one-day fee you to definitely depends on activities such as solution standing and you may whether you used a beneficial Virtual assistant financing prior to now. The level of their percentage hinges on the degree of your mortgage and the sort of financing you have made.

Traditional loan settlement costs and additionally believe the sort of loan you have made, the loan amount and your area. Settlement costs usually will vary anywhere between 3% and 6% of your own amount borrowed and can include assessment fees, lawyer website link charge and you can running costs you only pay your bank so you can processes your loan.

Minimal conditions to own conventional loan down payments usually begin anywhere between step 3% and you may 5% of a residence’s income rates, even though spending 20% is known as best by many loan providers and can reduce the rates of month-to-month homeloan payment.

Va funds not one of them people down payment, which could make homeownership less expensive to possess being qualified individuals. Purchasing money off normally, however, decrease your funding percentage and you may lower your monthly homeloan payment and attention.

Mortgage restrictions

Loan restrictions is adjusted periodically to suit changes in this new property market – the fresh standard traditional conforming financing limit from the U.S. to have 2023 are $726,two hundred, according to the Government Housing Money Agency. Its higher during the Alaska and you may Hawaii ($step one,089,300) since the average home values become more expensive when it comes to those nations.

Financial insurance coverage requirements

With a traditional loan, in case your down payment is less than 20%, your lender I) to have coverage up against default. That it adds to the month-to-month will set you back but may come off just after you are free to that loan-to-really worth proportion of about 80% otherwise all the way down.

Property restrictions

The problem and you may attributes out-of a property can affect whether your qualify for a normal loan. Criteria are very different, however, typically, you need to ensure the possessions match specific safety and habitability requirements – so if there’s extreme harm to the foundation or roof, you may be rejected otherwise want to make repairs before closing.