Secret Differences when considering Banking institutions and you can Borrowing from the bank Unions

When looking for an alternate examining otherwise family savings, mortgage or money account, you have a whole lot more selection than ever before. It is essential to consider most of the issues when deciding on an economic facilities. Finance companies and you will borrowing unions render of numerous similar services and products, however, you will find trick differences between both you to definitely users can get not know. Once we plunge greater into differences between both, it is vital to think about what matters very for you Automatic teller machine or branch access, benefits, costs, fees, on the internet attributes or area engagement? If you’re each other institutions offer you the capacity to safely shop and you will accessibility currency, you’ll find essential differences when considering them which can sway your choice on what can be your better banking solutions.

Funds In the place of Perhaps not-For-Finances

The most significant difference between banks and you will credit unions is that operationally, financial institutions try to have-profit and owned by investors, while credit unions commonly-for-earnings and you will owned by their customers, which in the credit relationship globe is called members. The primary aim of borrowing unions will be to render the brand new financial hobbies of your own community it serves and you can return profits to people, generally through finest costs, straight down costs, neighborhood outreach or other professionals. Bank profits visit the investors exactly who very own stock from inside the the corporation. These types of investors will most likely not have even a free account into bank but experience new economic advantages. You might be expected to discover credit unions facilitating factors designed to increase the monetary wellness of their people together with community into the several means, for example carrying out property or any other monetary fitness courses and giving borrowing from the bank guidance and other money.

Charges and Rates

Some one more profits is actually a philosophy in borrowing from the bank relationship way, and it is clear to see when comparing fees and you may rates so you’re able to antique financial institutions. As mentioned, finance companies need certainly to profit to incorporate dividends due to their people, and they usually do that from the battery charging highest charges. Many borrowing unions offer free examining levels when you find yourself finance companies you are going to fees a payment for examining account if you do not possess a large lowest equilibrium. Membership repairs charge normally money firms to have banking companies and you will the individuals costs are generally highest with banks than simply which have credit unions.

When choosing a lender, it is critical to go through the interest rates towards the each other dumps and you may funds. If at all possible we want to features high interest levels towards the coupons account minimizing prices to your automobile financing and you can mortgage brokers. These types of balance is normally attainable that have credit unions, however, due to the fact banking institutions have been in providers to make money, you may not always notice it with them. Large savings cost and lower financing costs cause smaller financial increases into consumer in the place of the financial institution.

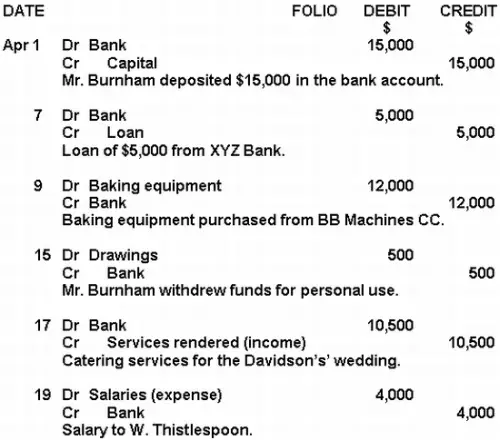

As of , the new NCUA S&P Around the world Cleverness database statement another assessment regarding average borrowing credit and loan costs anywhere between borrowing unions and you may banking institutions:

- Bank card, Classic % (rate) CU vs % (rate) Financial

- 5/one year Changeable Rates Financial dos.63% (rate) CU vs step three.55% (rate) Financial

- The newest Car finance, forty eight Weeks 2.86% (rate) CU 4.68% (rate) Bank

Automatic teller machine and Department Availability

Borrowing from the bank unions routinely have a mission out-of cooperation in an effort to greatly help the credit partnership movement as a whole thrive. A typical example of cash advance usa Stamford address so it collaboration one establishes them besides banking institutions is the usage of ATMs together with absence of fees relevant having ATMs, along with most cases, a shared circle away from twigs. In case your borrowing from the bank connection gets involved in a few of CO-OP Economic Services Community software, it’s possible to have usage of more than 29,000 surcharge-totally free CO-OP ATMs, which is far more ATMs than most banking companies. While doing so, while using an out-of-community server, credit unions have a tendency to fees lower Automatic teller machine costs than just banking companies. Based on a Forbes Advisor 2020 studies, the average borrowing from the bank relationship payment for making use of an out-of-community Atm are $.20 per deal compared to $1.15 to own finance companies.

If you’re one another finance companies and you can borrowing from the bank unions have the services to fulfill your financial requires, it is vital to understand gurus each economic facilities offers. In the first place chartered within the 1938 given that North park Condition Personnel Borrowing from the bank Commitment, SDCCU try molded to look after the newest monetary demands from local state government personnel. During the seventies, SDCCU stretched their operations so you’re able to serve most of the San Diegans now, is available to anyone life style otherwise operating throughout South Ca: Purple, La, Orange, Riverside, San Bernardino, San diego, San Luis Obispo, Santa Barbara or Ventura counties. Those people outside of the city can be open a free account by signing up for the fresh new Monetary Physical fitness Association. For additional info on SDCCU’s products, go to sdccu.

Head to our Monetary Training Blog site for more information suggestions for form upwards a powerful coming or sign up you Financial Wellness Wednesdays.