To be honest no body with similar credit history usually pay far more to make a larger advance payment, and no one with the exact same down-payment pays a whole lot more to have with a better credit score. People who have a good credit score scores are not subsidizing people with bad credit scores.

The problem is that most people do not see financial cost grids. Exactly what already been as the an ill-informed argument with the an excessively complicated home loan coverage try turned into a cynical treatment for mark homeownership to your community battles. It won’t works. Very, let’s need a careful go through the info and establish exactly what taken place, what exactly is being done, and you can everything we should do to make sure that everyone are handled fairly with regards to how much they costs locate home financing.

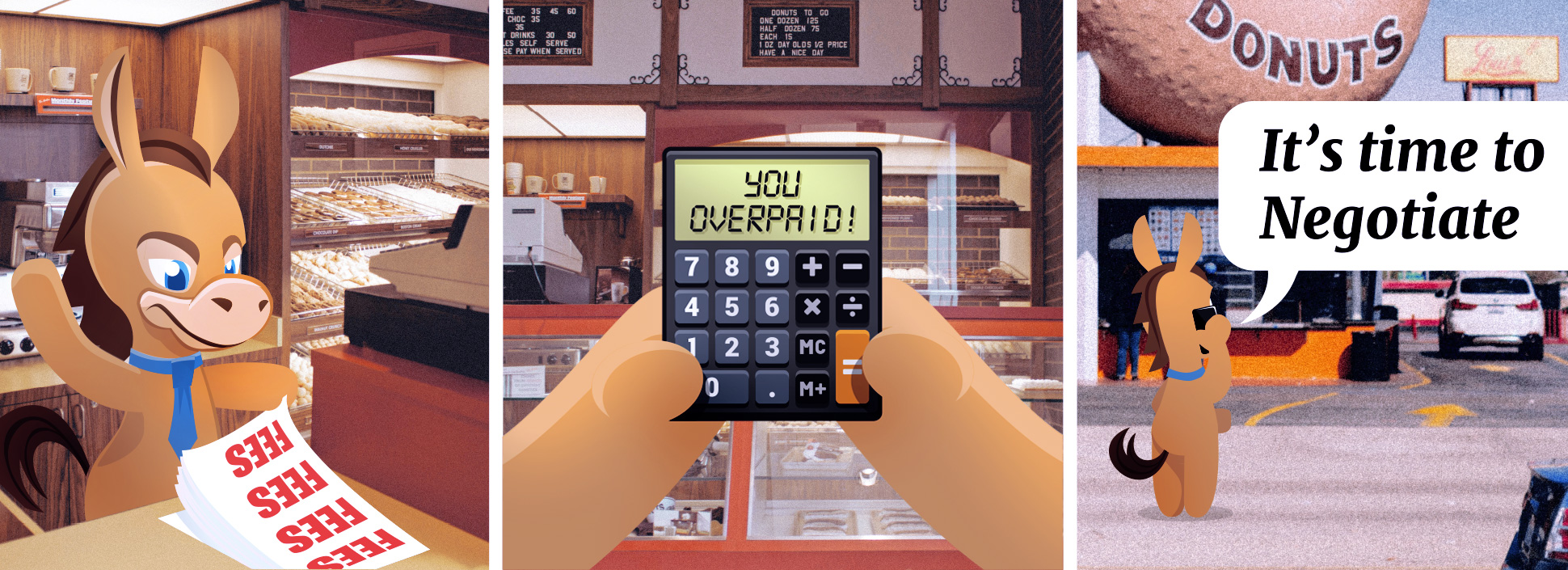

History week-end, the fresh new Wall structure Highway Record blogged an excellent scathing article alleging that another type of signal commonly increase home loan fees getting individuals having an excellent borrowing from the bank so you can subsidize highest-risk borrowers

The new Log reported one within the signal, and that gets into perception Can get step 1, home buyers with a good credit history more 680 pays on $forty a whole lot more every month toward a beneficial $400,000 mortgage. Those who create off repayments away from 20% to their land will pay the highest fees. People money will then be always subsidize higher-chance borrowers compliment of all the way down costs. Their end are that the is actually a beneficial socialization of risk you to definitely flies facing all the rational financial model, when you’re promising housing industry breakdown and you can putting taxpayers in danger of highest default costs. This isn’t genuine. The new taxpayers aren’t at any greater risk, and you can neither are homebuyers, lenders, otherwise someone else. The fresh accusations check one aspect regarding a complex picture one charge a great deal more for a lot of having higher downpayments that it cannot but it’s eliminated of the other parts of the equation.

The guy recommended that this is an endeavor so you’re able to force the GSEs to add best delivery having earliest-date homeowners which have down [credit] ratings, quite a few of just who could well be fraction borrowers, [as] has been expected by civil-rights and you will consumer activists to own many years

Dave Stevens, a former chairman of your Home loan Bankers Connection and you can FHA Administrator within the Obama administration penned regarding the fresh new cost grids inside the an op-ed for the Housing Cord towards the February 6, just a few months after the the new grids have been made public. Its pretty deep from the weeds, and never we seen they (plus me personally). The newest GSEs certainly are the Bodies-Backed Enterprises Fannie mae and you can Freddie Mac computer. This new grids is actually Loan Level Rate Adjustments (LLPAs) charged into some GSE loans given that an additional commission to protect facing credit chance traditionally covered by home loan insurance coverage, called for toward GSE financing that have down costs below 20%.

The problem are found of the Ny Writeup on April 16, towards the headline The way the You are subsidizing high-exposure homeowners – at the cost of individuals with good credit. It don’t take long to possess FOX Company Reports to grab the storyline a few days after that, in which Stevens said he previously merely acquired a message off a good bank exactly who told you, thus i imagine we have to illustrate borrowers to worsen its credit in advance of they make an application for a loan. It is a creative speaking part. It really has-been wrong, but ideal for around three information sites belonging to Rupert Murdoch.

Once the brand new Wall structure Road Record had written its article, new narrative was every where, and additionally Newsweek, Members of Congress towards both sides of aisle were consistently getting calls off their constituents who had been outraged. They had worse to your CNBC when point Becky Short come the fresh interview because of the claiming individuals which have a good credit score ratings do spend high fees if you find yourself riskier buyers gets so much more good conditions. Stevens doubled off, proclaiming that lowest-borrowing from the bank quality consumers are cross-subsidized of the individuals with higher credit ratings and better downpayments. Process Vow chairman and you will originator John Guarantee Bryant accurately said it is not in the credit scores, which is true, immediately after which told you the brand new allegation try theoretically right, that it is not. On Friday, Housing Financial Functions Chairman Patrick McHenry (R-Letter.C.) and you may Houses and you can Insurance rates Subcommittee President Warren Davidson (R-Ohio) typed so you can FHFA Director Sandra Thompson, insisting one she repeal brand new LLPA change. The challenge including emerged during the a hearing of Senate Financial, Houses and you may Metropolitan Affairs Committee.

Exactly how did each of them obtain it thus completely wrong? While the exposure-centered cost grids are extremely difficult, and even a home loan pro such Stevens and you may a highly known creator instance Small is also misread them, clearly regarding graph lower than. This new red packets was LLPAs that are lower for those who have lower down costs compared to those payday loans Blue Sky recharged for individuals who lay a whole lot more than 20% down with the exact same credit history. I accept Stevens that factor isnt reasonable, but it’s nonetheless a moment costs, just like the line off to the right can make clear. This proves the greatest costs differential amongst the >20% down payments additionally the