USDA finance present exclusive path for qualified people to read their dreams of homeownership in the Maryland’s rural and you may residential district countries.

Whether you’re a primary-big date customer or seeking to improve so you’re able to a much bigger assets, good USDA financing also provides good terms and conditions and also make your own hopes and dreams an excellent truth. Partner that have Griffin Capital to get into competitive costs and you can specialist advice every step of the ways, making certain your grab an entire possible associated with the priceless chance for homeownership inside the Maryland.

What exactly is a great USDA Mortgage?

Good USDA loan , theoretically referred to as USDA Outlying Invention Protected Homes Mortgage System, is a mortgage system provided by the usa Company out of Agriculture (USDA). They will let some body and you can families inside to buy house when you look at the rural and residential district components having favorable terms. Qualifications is dependent on property place and you may borrower money, which have benefits including zero downpayment and you will competitive rates of interest. These financing are protected by USDA, with income restrictions and you can property conditions to make certain protection and you may habitability.

Overall, USDA money give a low-income mortgage selection for people and you will family members looking to buy residential property when you look at the designated outlying and residential district section. They offer positives such as no advance payment, low interest, and you can backing regarding the USDA, and also make homeownership a whole lot more possible for those who will most likely not be eligible for conventional funds.

USDA Financing Criteria for the Maryland

In ent fund features certain conditions that consumers need certainly to online payday loan California see so you can qualify for such home loan. Here are the standard USDA loan conditions within the Maryland:

- Possessions Qualifications : The house or property are funded need to be situated in a designated outlying town or an eligible residential district city centered on USDA direction. Individuals can use the newest USDA’s online map unit to check the newest qualification away from a specific property.

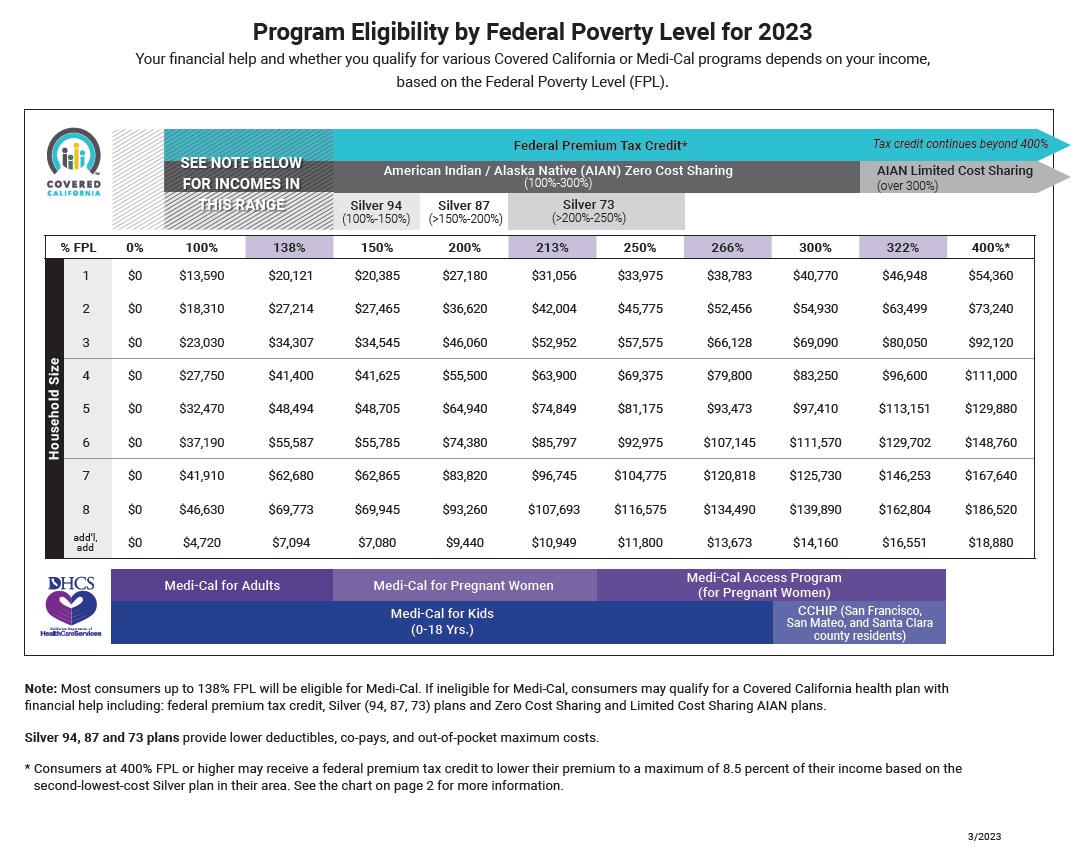

- Income Qualifications : USDA finance enjoys money constraints according to the area’s median earnings. Individuals must make sure you to definitely its domestic income doesn’t go beyond these types of restrictions so you can be eligible for a good USDA loan. Earnings limits vary according to number of people regarding house as well as the condition where home is found.

- You.S. Citizenship or Long lasting Abode : Borrowers need to be U.S. owners, non-citizen nationals, otherwise certified aliens that have legitimate house in the us.

- Credit rating : If you find yourself USDA finance normally have significantly more versatile credit requirements versus old-fashioned funds, individuals are at the mercy of credit research. At least credit score may be required because of the bank, although this may differ.

- Debt-to-Income (DTI) Ratio : Lenders often assess borrowers’ debt-to-money proportion, which is the percentage of gross monthly earnings you to definitely visits using bills. While there’s absolutely no strict limit DTI specifications lay from the USDA, loan providers usually like borrowers which have good DTI out of 41% otherwise lower.

- Stable Money and you may Work : Individuals need a stable revenue stream and you may work. Lenders generally require at least 2 years from steady a career records.

- Ability to Manage Installment : Individuals need certainly to have indicated their ability to cover the new month-to-month mortgage payments, possessions taxation, insurance rates, and other property-related costs.

Meeting these bank-particular requirements, together with USDA qualifications criteria, is essential for consumers trying to a beneficial USDA loan, if they want to buy a current property otherwise make an application for good USDA design loan during the Maryland. However some autonomy can be obtained, individuals would be to aim to bolster the economic reputation to change its chances of recognition and you may safe good financing words.

Advantages and disadvantages from USDA Fund

Contained in this segment, we shall mention the advantages and you can disadvantages out of an excellent USDA loan so you can funds your residence purchase. By the investigating the advantages and you will prospective drawbacks, you’ll obtain an intensive knowledge of if or not a beneficial USDA outlying invention financing during the Maryland aligns with your homeownership requirements.

- No down payment : One of several benefits associated with USDA funds would be the fact they often times require no advance payment, and also make homeownership significantly more obtainable for those having limited coupons.

- Low interest : USDA fund generally speaking bring aggressive rates of interest compared to conventional mortgages, enabling consumers reduce notice over the lifetime of the financing.